All expenses must be adequately accounted for within 90 days or the expenses will be reported as taxable income to the employee and the travel card suspended.

This policy has been implemented to meet the "reasonable period of time" in the IRS accountable plan. Expenses that fall within the IRS accountable plan are not reported as taxable income to the employee.

IRS Accountable Plan

- expenses must have a business connection

- must adequately account for these expenses within a reasonable period of time

- must return any excess reimbursement or allowance within a reasonable period of time

Travel

- Submission of expense report within 90 days of travel end date

- Best practice is to submit within 30 days

- Applies to out of pocket and travel card transactions

- If not submitted within 90 days of travel end date

- Travel card immediately suspended until expense report is submitted and approved

- Expenses become tax reportable income to the employee and a tax withholding form must be attached to the expense report

- Unassigned travel card transactions assigned to an expense report within 90 days of post date

- Documents travel end date, which allows for aging/tracking of expenses

- Best practice is to assign transactions within 30 days

- After 60 days lose dispute rights with the bank

- If not assigned within 90 days of post date

- Travel card immediately suspended until transactions are assigned to an expense report and the travel end date can be evaluated

- If the travel end date is less than 90 days, the card suspension will be removed

- If travel end date is older than 90 days, the expenses become tax reportable income to the employee and card will remain suspended until expense report is submitted and approved

- Third Strike Rule: for cards suspended for the third time

- Travel Card will be suspended for one year with notification of card suspension sent to traveler, department head, assistant dean and dean/VP.

- No travel advances will be made available to the employee during this time period

Purchase

- For any reimbursement request outside of travel expenses; must be submitted for reimbursement within 90 days of the receipt date or, in the case of a working fund project, completion date

- Best practice is to submit reimbursement requests within 30 days

- Any reimbursement request older than 90 days should include a request for tax withholding form

Tools Available to Track Concur Aging Transactions and Expense Reports

- Concur automated email generated to the traveler and delegates for any unassigned transactions not assigned to an expense report 30 days from post date

- Concur automated email generated to the traveler and delegates for any expense report not submitted 30 days from the travel end date

- Monthly aging transaction report distributed to the first approver on FAMIS screen 919 for each department

- Weekly aging report for transactions greater than 60 days submitted to the CSBA rep for each college/division

- Weekly summary report distributed in the Controller Connection on Wednesdays

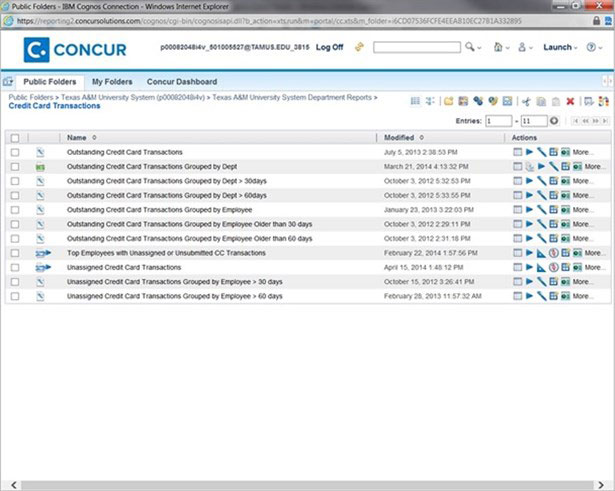

- Standard reports available to departments to run at any time